- Solutions

- Products

- Community

- Resources

- Company

Create incredible candidate experiences that communicate your brand, mission, and values with recruitment marketing solutions.

Learn moreCommunicate effectively and efficiently with the candidates that can drive your business forward.

Learn moreSelect the right candidates to drive your business forward and simplify how you build winning, diverse teams.

Learn moreHelp your best internal talent connect to better opportunities and see new potential across your entire organisation.

Learn moreCommunicate collectively with large groups of candidates and effectively tackle surges in hiring capacity.

Learn moreAccess tools that help your team create a more inclusive culture and propel your DEI program forward.

Learn moreRebound and respond to the new normal of retail with hiring systems that are agile enough to help you forge ahead.

Learn moreAccelerate the hiring of key talent to deliver point of care and support services that meet and exceed your promise of patient satisfaction.

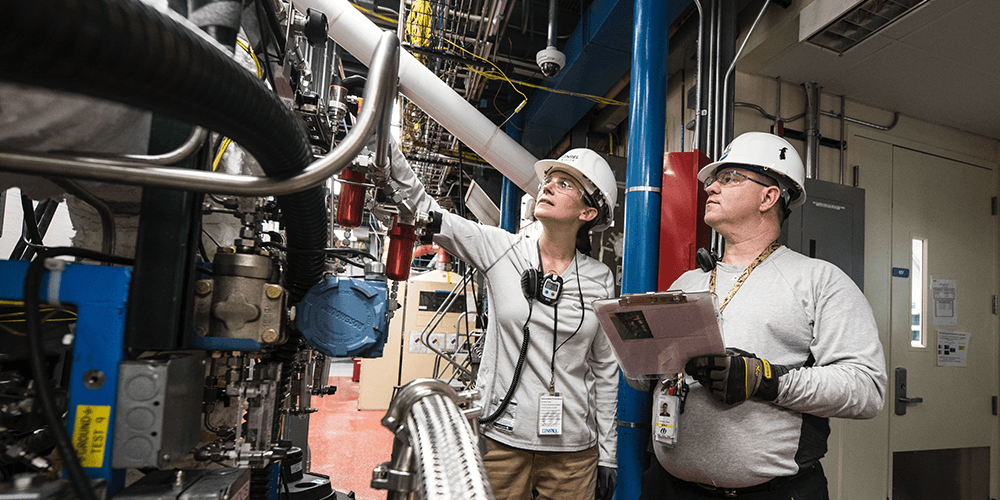

Learn moreAttract and engage candidates with technical competencies, accelerate hiring for much-needed skills, and advance expertise within your valued workforce.

Learn moreSimplify how you recruit finance, insurance, and banking candidates with a unified platform built to match top talent with hard-to-fill roles.

Learn moreYour business strategy depends on your people strategy. Keep both in lockstep with the iCIMS Talent Cloud.

Learn moreBuild an engaging, high-converting talent pipeline that moves your business forward.

Learn moreDeliver the innovation your talent team needs, along with the global scale and security you demand.

Learn moreDeliver tailored technology experiences that delight users and power your talent transformation with the iCIMS Talent Cloud.

Learn moreThe #1 ATS in market share, our cloud-based recruiting software is built for both commercial and large, global employers.

Learn more Talk to salesAttract the best talent for your business with powerful, on-brand career websites that excite candidates and drive engagement.

Learn more Talk to salesCombine behavior-based marketing automation with AI insights to build talent pipelines, engage candidates with multi-channel marketing campaigns, and automatically surface the right talent for the job.

Learn more Talk to salesEmpower candidates with automated self-service, qualification screening, and interview scheduling through an AI-enabled digital assistant.

Learn more Talk to salesSimplify employee onboarding with automated processes that maximize engagement and accelerate productivity.

Learn more Talk to salesRecruit in the modern world and expand your reach with built-in virtual interviewing.

Learn more Talk to SalesFocus on qualifying candidates faster with fully integrated language assessments.

Learn more Talk to SalesImprove employee experience, retention, and reduce internal talent mobility friction with the iCIMS Opportunity Marketplace.

Learn more Talk to salesCompliment your sourcing and engagement efforts with sophisticated lead scoring and advanced campaign personalization.

Learn more Talk to salesModernize, streamline, and accelerate your communication with candidates and employees.

Learn more Talk to salesTransform the talent experience by showcasing your authentic employer brand through employee-generated video testimonials.

Learn more Talk to salesGive your business a competitive edge with a complete solution for creating personalized, timely, and accurate digital offer letters that inspire candidates to want to join your team.

Learn more Talk to SalesSimplify recruiting, dynamically engage talent, and reduce hiring bias with job matching and recruiting chatbot technology.

Learn more Talk to salesThe #1 ATS in market share, our cloud-based recruiting software is built for both commercial and large, global employers.

Learn more Talk to salesAttract the best talent for your business with powerful, on-brand career websites that excite candidates and drive engagement.

Learn more Talk to salesCombine behavior-based marketing automation with AI insights to build talent pipelines, engage candidates with multi-channel marketing campaigns, and automatically surface the right talent for the job.

Learn more Talk to salesEmpower candidates with automated self-service, qualification screening, and interview scheduling through an AI-enabled digital assistant.

Learn more Talk to salesSimplify employee onboarding with automated processes that maximize engagement and accelerate productivity.

Learn more Talk to salesCompliment your sourcing and engagement efforts with award-winning lead scoring and advanced campaign personalization.

Learn moreImprove employee experience, retention, and reduce internal talent mobility friction with the iCIMS Opportunity Marketplace.

Learn more Talk to salesModernise, streamline, and accelerate your communication with candidates and personnel.

Learn more Talk to salesTransform the talent experience by showcasing your authentic employer brand through employee-generated video testimonials.

Learn more Talk to salesSimplify recruiting, dynamically engage talent, and reduce hiring bias with job matching and recruiting chatbot technology.

Learn more Talk to salesHow PRMG attracts 50% more applicants for niche finance roles with the iCIMS Talent Cloud.

Learn moreThousands strong, our global community of talent professionals includes creatives, innovators, visionaries, and experts.

Learn moreTogether we’re creating the world’s largest ecosystem of integrated recruiting technologies.

Learn morePartner with our global professional services team to develop a winning strategy, build your team and manage change.

Learn moreExplore our network of more than 300 certified, trusted third-party service and advisory partners.

Learn moreExpert guidance about recruitment solutions, changes in the industry, and the future of talent.

Learn moreExpert guidance about recruitment solutions, changes in the industry, and the future of talent.

Learn moreStay up to date with the latest terminology and verbiage in the HR software ecosystem.

Learn morePartner with iCIMS to build the right strategies, processes, and experience to build a winning workforce.

Learn moreThe iCIMS Talent Cloud delivers a secure, agile, and compliant platform designed to empower talent teams, job seekers, and partners with advanced data protection and privacy.

Learn moreWatch the recording of our latest webinar looking at key findings from a recent study and explore short-term and long-term solutions for the talent crisis in 2022 and beyond.

Watch on-demandView press releases, media coverage, and the latest hiring data. See what analysts are saying about iCIMS.

Learn moreiCIMS is the Talent Cloud company that empowers organizations to attract, engage, hire, and advance the talent that builds a winning workforce.

Learn moreGet to know the award-winning leadership team shaping the future of the recruiting software industry.

Learn moreWe believe the future of work isn't something that "happens" to you. It's something you create. We actively create the future of work with our customers every day.

Learn moreStreamline your tech stack and take advantage of a better user experience and stronger data governance with ADP and the iCIMS Talent Cloud.

Learn moreThe combined power of iCIMS and Infor helps organizations strategically align their business and talent objectives.

Learn moreOur award-winning partnership with Microsoft is grounded in a shared desire to transform the workplace and the hiring team experience.

Learn moreOur partnership with Ultimate Kronos Group (UKG) supports the entire talent lifecycle by bringing frictionless recruiting solutions to UKG Pro Onboarding.

Learn moreLet’s get in touch. Reach out to learn more about iCIMS products and services.

Learn more

I recently fielded a question from a journalist about the job prospects for workers laid off from nuclear power plants, and it turned out to be a case study in 21st century employment dislocation. It’s not just that there aren’t a lot of new jobs at utilities, or that layoffs have been hitting nuclear power plants in states across the U.S. The heart of the problem lies in the specificity of the workers’ skills and the challenges they will face in finding a job at their previous income level, but there are lessons here for workers, employers, and policy makers alike.

On its face, it looks like a job seeker’s market in utilities as much as anywhere in today’s tight labor market. iCIMS data indicate that competition for the most utility-related jobs has declined by about 20-30% since 2015. In theory, laid-off workers should face less competition for getting replacement jobs at other utilities, but there are two big caveats here.

First, the lower average number of applicants per position may reflect workers fleeing the industry as much as anything else – not unlike certain press reports of why it has been so hard to recruit new truckers. Second, since utilities tend to be local monopolies, they tend to be pretty spread out geographically. That means moving to another job in the same industry but a different location is more likely to be disruptive and difficult for utilities workers than for workers in other industries. This challenge is exacerbated by recent declines in geographic labor mobility across the U.S., which suggest it’s only getting harder to make such a move.

What about switching industries? According to BLS data on total payrolls by sector, utilities is pretty small, so other industries might be able to absorb utilities workers fairly readily.

However, the BLS reports that within power utilities in 2017, over 30% of the employees were in “Installation, Maintenance, and Repair Occupations” and many of those are likely to focus on machine-specific skills that do not translate well to other industries. Moreover, when you compare their absolute numbers, they actually dwarf their compatriots in the subsector of machinery manufacturing (which I’ve focused on to strip out less relevant categories like textile or agricultural manufacturing), although it’s true they are themselves dwarfed by their compatriots in broad sector of construction.

Another 13% of the utilities workforce holds “production” occupations that often require operating task-specific machinery with one’s hands. While the further 11% who are in architecture and engineering occupations are usually considered high skilled, they may also be quite specialized and thus forced to accept some kind of pay cut if they transition to a new industry.

Indeed, for most occupation types, the question of replacement income looms large. As the table below demonstrates, even when looking at the same broad occupational category, employees in power utilities have higher average wages than in construction and machinery manufacturing. This wage premium for utilities holds even when you look at occupations where you might expect that there is particularly strong overlap in skills across industries, such as administrative positions. It even holds across occupations like management and finance, albeit to a lesser extent.

The higher wages may be related to the significantly higher rate of unionization in the utilities sector. Unfortunately, the BLS unionization data isn’t very granular, which may help explain why it doesn’t correlate perfectly with the differences in wages. Still, it seems notable that that wage premium for utilities is higher for administrative and maintenance occupations than accounting or management.

This situation underlines our intermittent national conversation about the quality of new jobs. It’s a subject prone to bellyaching, but what do these facts and figures suggest can actually be done about any of this?